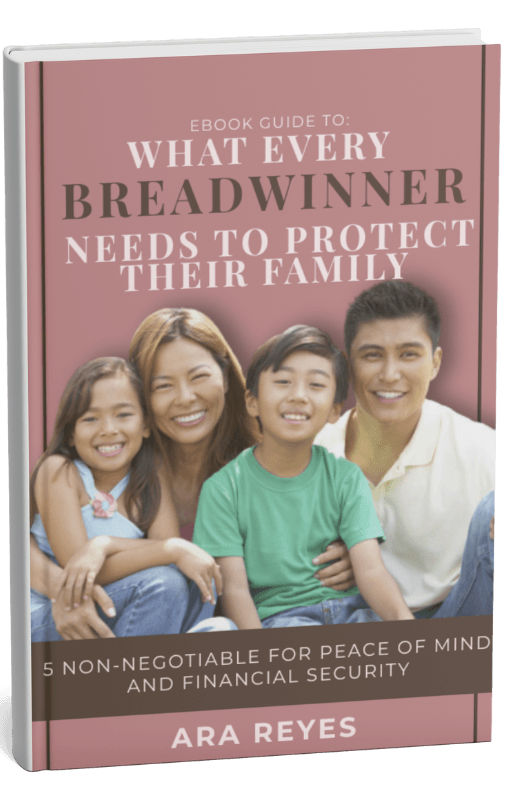

5 Non-negotiable for Peace of Mind and Financial Security

What Every Breadwinner Needs to Protect Their Family

Download this free guide and learn the 5 essential protections every hardworking provider needs to secure their loved ones’ future. Whether you're the main income earner or just want to make sure your family is financially ready for anything, this guide gives you the tools, clarity, and confidence to take control.

5 Non-negotiable for Peace of Mind and Financial Security

What Every Breadwinner Needs to Protect Their Family

Download this free guide and learn the 5 essential protections every hardworking provider needs to secure their loved ones’ future. Whether you're the main income earner or just want to make sure your family is financially ready for anything, this guide gives you the tools, clarity, and confidence to take control.

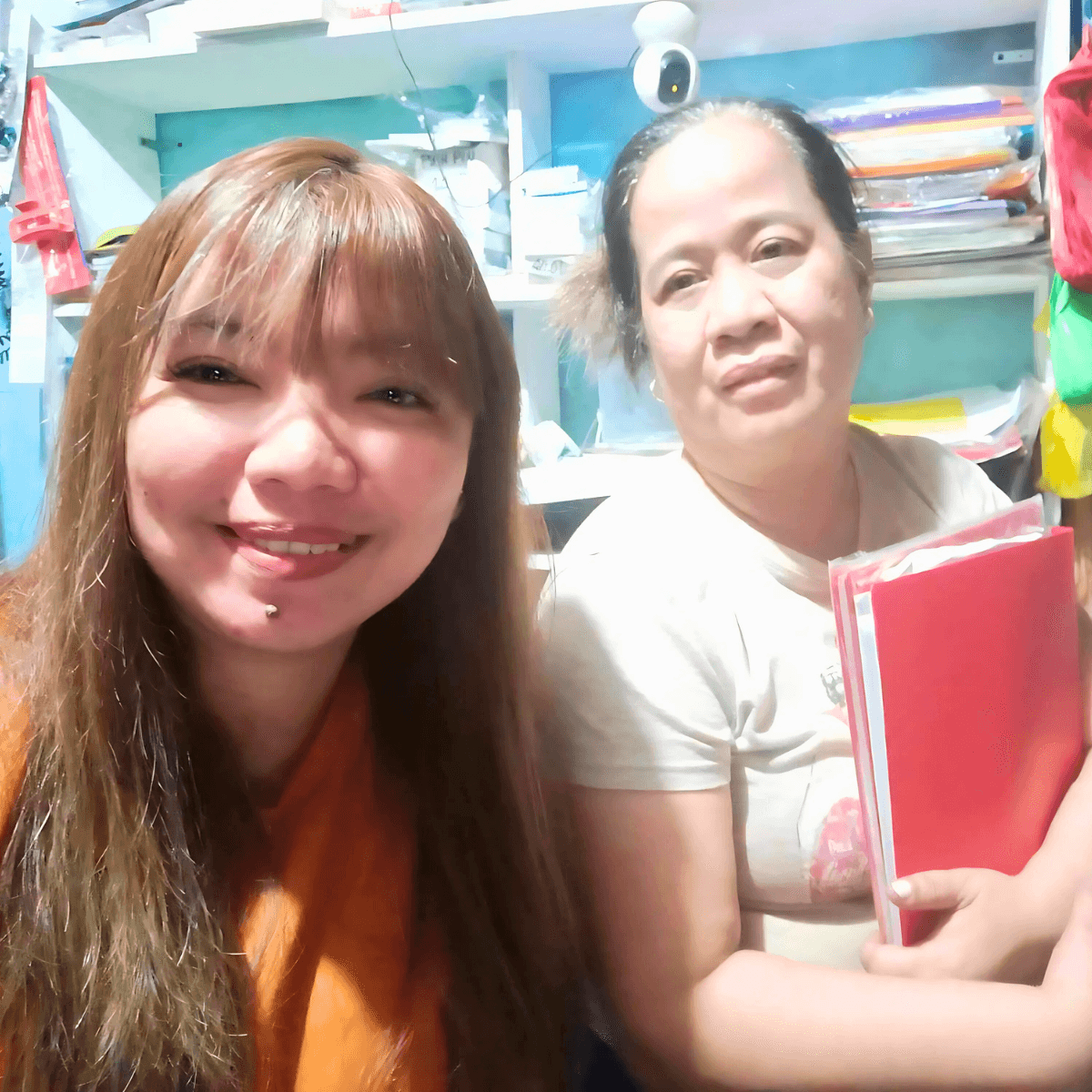

"Narealize ko kasi after ma-hospital ni Mama na ang liit ng HMO coverage ko na extended sa kanya. Kaya kumuha ako ng isa pang policy na dedicated sa Health Coverage ko talaga."

Odee

"Narealize ko kasi after ma-hospital ni Mama na ang liit ng HMO coverage ko na extended sa kanya. Kaya kumuha ako ng isa pang policy na dedicated sa Health Coverage ko talaga."

Odee -

What You’ll Learn Inside This Free Guide:

The Top 5 Must-Have Protections Every breadwinner should have—and how to get started on any budget

Breadwinner’s Needed Protections

Learn the five key

financial safeguards, including life, health, and disability insurance, plus emergency funds and estate planning.

Practical, Step-by-Step Guidance

Follow actionable steps and easy checklists to confidently select the right insurance, build your emergency fund, and secure your family’s future starting today.

Real-Life Examples and Expert Tips

Discover inspiring Filipino stories and trusted advice from insurance professionals to avoid pitfalls, save money, and strengthen your family’s financial security.

What You’ll Learn Inside This Free Guide

The Top 5 Must-Have Protections Every breadwinner should have—and how to get started on any budget

Breadwinner’s Needed Protections

Learn the five key

financial safeguards, including life, health, and disability insurance, plus emergency funds and estate planning.

Practical, Step-by-Step Guidance

Follow actionable steps and easy checklists to confidently select the right insurance, build your emergency fund, and secure your family’s future starting today.

Real-Life Examples and Expert Tips

Discover inspiring Filipino stories and trusted advice from insurance professionals to avoid pitfalls, save money, and strengthen your family’s financial security.

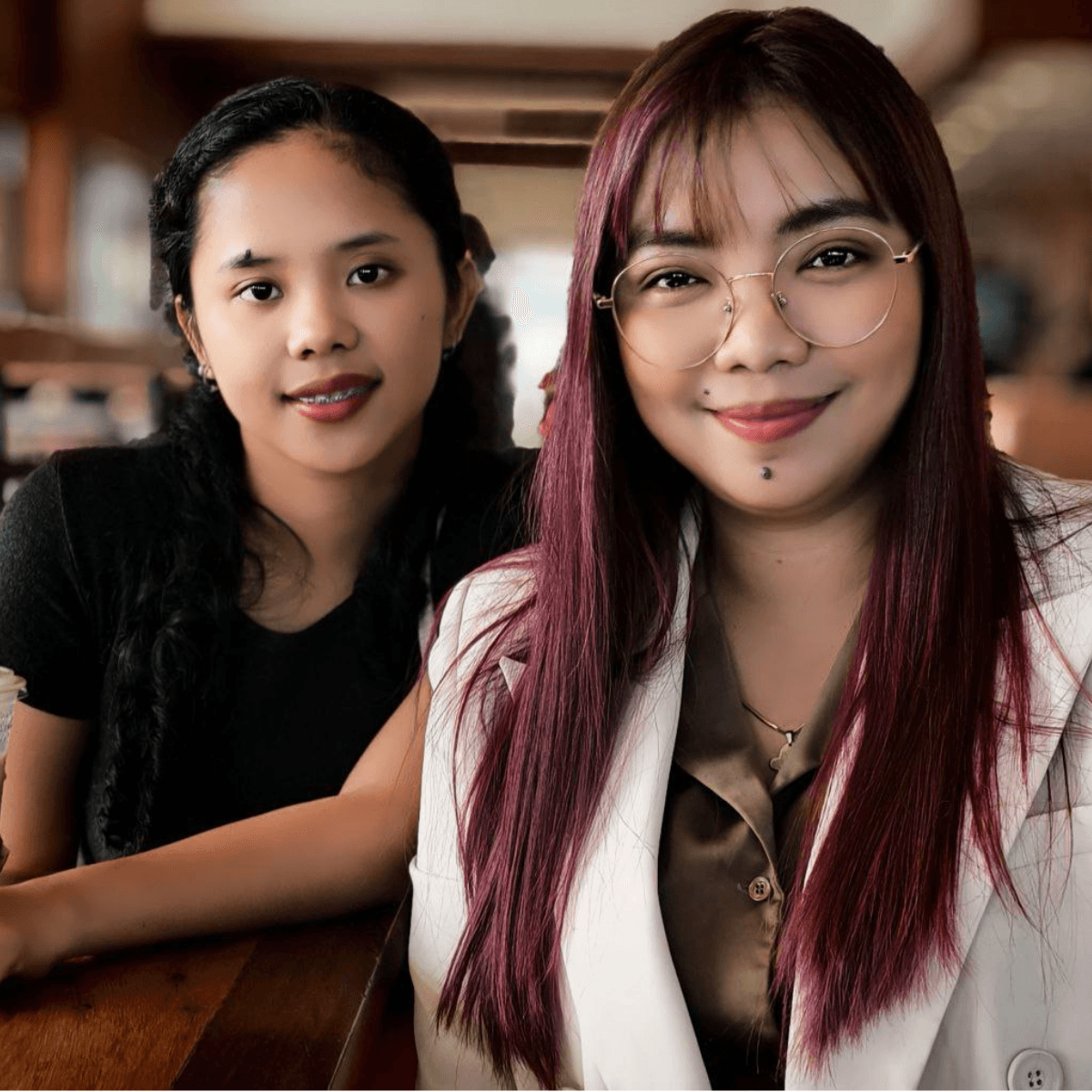

About me

ARA REYES

With over five years in the insurance industry and 17 years in Human Relations Development,

I am committed to guiding Gen Y and Gen Z professionals toward achieving their life goals and financial independence.

As a Financial Planner, I specialize in Financial Needs Analysis, Mentorship-Based Client Relationships, and Human-Centered Risk Advising—combining strategy with empathy to create lasting impact.

My approach goes beyond numbers; it’s about empowering individuals with the knowledge and confidence to build a future of security, freedom, and opportunity.

Whether you're here to learn, collaborate, or explore financial possibilities,

I look forward to walking alongside you in your journey toward financial success!

ABOUT ME

ARA REYES

With over five years in the insurance industry and 17 years in Human Relations Development,

I am committed to guiding Gen Y and Gen Z professionals toward achieving their life goals and financial independence.

As a Financial Planner, I specialize in Financial Needs Analysis, Mentorship-Based Client Relationships, and Human-Centered Risk Advising—combining strategy with empathy to create lasting impact.

My approach goes beyond numbers; it’s about empowering individuals with the knowledge and confidence to build a future of security, freedom, and opportunity.

Whether you're here to learn, collaborate, or explore financial possibilities,

I look forward to walking alongside you in your journey toward financial success!

What others are saying about us:

"Kailangan ko po ng Insurance kasi may napupuntahan po

ang sahod ko"

“Totoo po, if hindi magiipon, puro gastos talaga at labas ng pera. Kaya kailangan ko din ang insurance kasi may napupuntahan ang sahod ko at nakakapagipon pa ako.”

Kim

"Pwede na kaming magipon magasawa"

“Pwede na kaming magipon magasawa para sa sarili namin dahil napunuan na namin ang funds ng aming mga anak! Thank you, Ara sa pagshare ng insurance sa akin”

Mamsh

"Isa para sa income ko, isa para sa retirement protection"

“Isa po ito sa dinagdag ko sa plano ko para yung isa for income protection, yung isa naman pang retirement ko, atleast pareho pa silang may critical illness protection!”

Nina

What others are saying about us:

"Kailangan ko po ng Insurance kasi may napupuntahan po ang sahod ko"

“Totoo po, if hindi magiipon, puro gastos talaga at labas ng pera. Kaya kailangan ko din ang insurance kasi may napupuntahan ang sahod ko at nakakapagipon pa ako.”

Kim

"Pwede na kaming magipon magasawa"

“Pwede na kaming magipon magasawa para sa sarili namin dahil napunuan na namin ang funds ng aming mga anak! Thank you, Ara sa pagshare ng insurance sa akin”

Mamsh

"Isa para sa income ko, isa para sa retirement protection"

“Isa po ito sa dinagdag ko sa plano ko para yung isa for income protection, yung isa naman pang retirement ko, atleast pareho pa silang may critical illness protection!”

Nina

ALL RIGHTS RESERVED. ARA REYES 2025

ALL RIGHTS RESERVED. ARA REYES 2025